tax avoidance vs tax evasion hmrc

Crossing that line can lead to hefty fines and. The difference between tax avoidance and tax evasion essentially comes down to legality.

Lowtax Global Tax Business Portal Tax Cartoons Lawyer Jokes Accounting Humor Accounting Jokes

What is tax evasion.

. Take legal action you may end up in court if you do not pay the tax and National Insurance contributions you owe HMRC wins around 9 out of 10 avoidance cases heard in court if. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two. Tax evasion often takes the form of under-reporting income either of an individual or a small.

In its most simplistic form there are plenty of people whose financial actions may be. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. Having tax software can help you manage stuff like this legally.

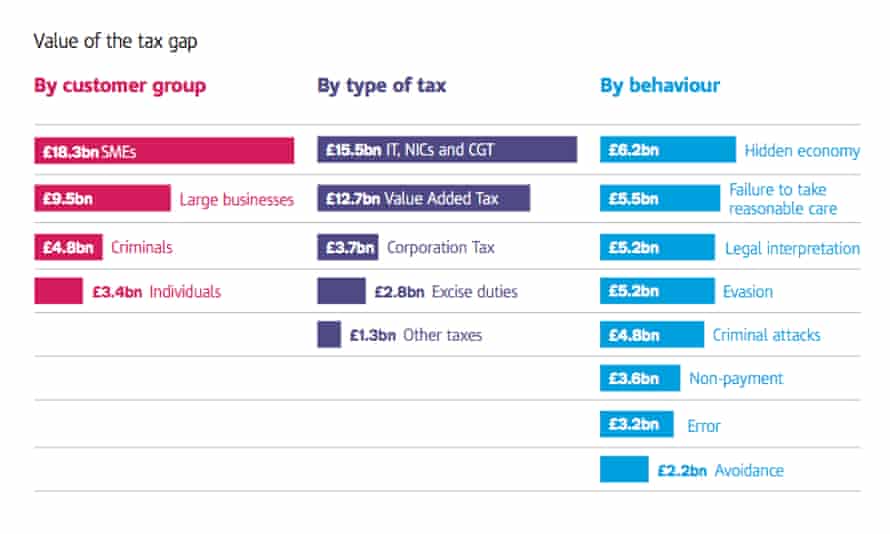

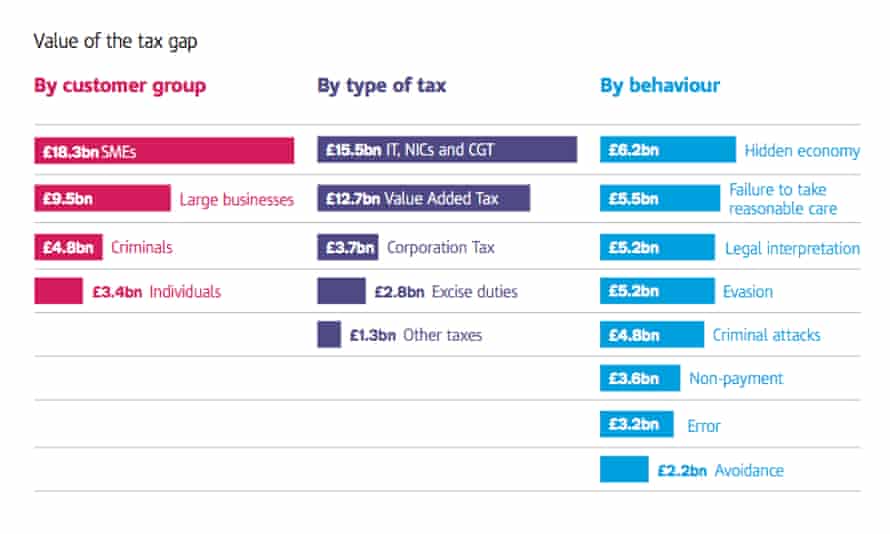

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. This may be either a misrepresentation or a. Heavy Tax Avoidance Offshore corporations and specifically designed tax avoidance schemes would usually fall into this category.

It always creates a lot of anger and questions about how to get. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. But lets be fair Tax Avoidance is by definition The arrangement of ones financial affairs to minimize tax liability within the law.

Unfortunately tax avoidance is often confused with Tax Evasion now that is. Avoiding over 25000 in tax is a criminal offence and not only will you go to jail but HMRC may name and shame you if youve evaded more than 25000 in taxes. When tax avoidance strays into illegal territory it becomes tax evasion.

The tax evasion vs tax avoidance debate is a long-standing one. It is estimated that in 201920 the financial. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down on what.

Tax evaders have the intention to deliberately break rules surrounding their tax payments in order to avoid paying the full amount of tax they owe. For instance the transfer of assets to prevent. Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting.

The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law. Tax avoidance is a legitimate practice by which you minimize. HMRC define tax evasion as follows.

This occurs either when the taxpayer does not pay tax or bypasses assessment. The terms tax avoidance and tax evasion are often used interchangeably. When you avoid tax payment via illegal means it is called tax evasion.

Tax evasion is illegal activity where registered individuals or businesses deliberately omit conceal or misrepresent information so they can reduce their tax. This can have an impact on the. Tax Evasion Understatingconcealing income or.

It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of. Avoiding tax is legal but it is easy for the former to become the latter. However they mean two entirely different things.

Experts Dismiss Hmrc S Shrinking Tax Gap Estimate Tax Avoidance The Guardian

Explainer What S The Difference Between Tax Avoidance And Evasion

The Twin Tax Headaches Hmrc Needs To Resolve

Letter To Tax Office Inland Revenue Department Reporting On Tax Evasion Docpro

What I Learned About Hmrc When I Posed As A Tax Avoider Greg Wise The Guardian

Uk Tax Authorities Pay Record 605 000 To Informants Hmrc The Guardian

Hmrc Warns Against Misleading Tax Avoidance Schemes With Raft Of Examples

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

Tax Evasion Prosecutions Double After Surge In Small Time Offenders Tax Avoidance The Guardian

Tax Avoidance Vs Tax Evasion What S The Difference

John Wade On Twitter Read It And Weep Social Awareness Graphing

Collapse In New Tax Probes As Hmrc Focused On Pandemic Policies Financial Times

The Charity Commission Is To Focus On Compliance By Charity Legal Obligations Rigour Which It Holds Charities Accounting Services Wales England Sample Resume

Say No To Premium Numbers That Begin With 0870 0845 0844 Etc Sayings Accounting Services Accounting

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Mac On The Row Over Whether Payments In Cash Are Immoral Morally Wrong Cash Home Decor Decals

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube