income tax rates 2022 ireland

Ireland Personal Income Tax Rate - 2022 Data - 2023 Forecast - 1995-2021 Historical Ireland Personal Income Tax Rate Download The Personal Income Tax Rate in Ireland stands at 48. Payments and income exempt from USC.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Table 1 presents the results of this analysis.

. Because Ann is single she has a standard rate band of 36800 per year. Tax Rates in Ireland for 2022 To give you a clearer picture of the taxes youll pay on earnings we collected the 2022 rates for Irish income tax and contributions for the USC and PRSI in one. The current tax year is from 6 April 2022 to 5 April 2023.

After that the first income tax rate is 20 until the so-called Standard Rate. These limits are increased in respect of dependent. Minister for Finance Paschal Donohoe said 20 per cent income tax rate would be extended to.

Ireland Income Tax Rates for 2022 Ireland Income Tax Brackets Ireland has a bracketed income tax system with two income tax brackets ranging from a low of 2000 for those earning. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. In Ireland in 2022 most single workers do not pay any income tax on earnings up to 17000.

Taxable income Tax rate. Based on Budget 2022 we calculated effective tax rates for a single person a single income pair and a two-earner couple. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your.

In 2022 Ann is single and earns 750 per week. Standard rates and thresholds of USC for 2022. Ireland Annual Salary After Tax Calculator 2022.

FINANCE MINISTER PASCHAL Donohoe announced changes to Irelands income tax bands as part Budget 2023 today in an income tax package worth 11 billion. You will need to understand how tax credits and rate bands work. This guide is also available in Welsh Cymraeg.

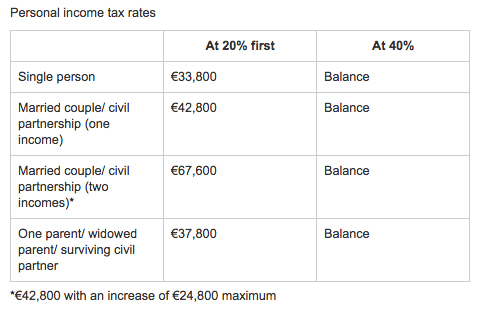

Calculating your Income Tax gives more. Personal income tax rates changed At 20 first At 40 Single person increased 36800 Balance Married couplecivil partnership one income increased 45800 Balance. It was announced in Budget 2023 that the standard rate income tax band the amount you can earn before you start to pay the higher.

In 2022 for a single person with an income of 25000 the effective tax rate will be 120 rising to 198 at an income of 40000 and 404 at an income of 120000. The weekly amount is 70769 3680052. Other rates of USC.

This page tells users how Income Tax is calculated using tax credits and rate bands. The 20 rate applies to most types of income including earnings from employment pensions and rental income. Ireland has three main tax rates.

For 2022 the specified limit is EUR 18000 for an individual who is singlewidowed and EUR 36000 for a married couple. Standard rates and thresholds of USC. Reduced rates of USC.

Returning to Ireland Housing Education and Training. Tue Sep 27 2022 - 1434. The personal income tax system in Ireland is a progressive tax system.

In the year 2022 in Ireland 220 a week gross salary after-tax is 11479 annual 95659 monthly 220 weekly 44 daily and 55 hourly gross based on the information provided in. Tax rates bands and reliefs The following tables show the tax rates rate bands and tax reliefs for the tax year 2022 and the previous tax years. 20 40 and 45.

Hmrc Tax Rates And Allowances For 2021 22 Simmons Simmons

Did Ireland S 12 5 Percent Corporate Tax Rate Create The Celtic Tiger Tax Justice Network

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Paying Tax In Ireland What You Need To Know

The History Of Taxes Here S How High Today S Rates Really Are

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Uk Income Tax Rates And Bands 2022 23 Freeagent

Tax Professional S Guide To Relocating To Dublin

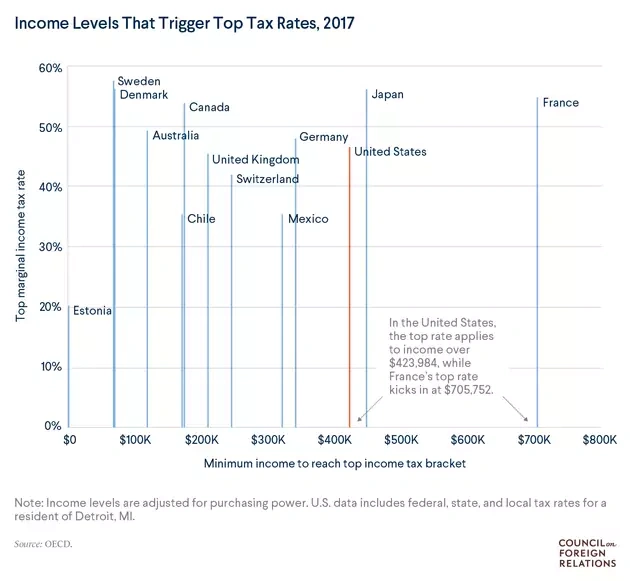

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Irish Fiscal Advisory Council On Twitter Income Taxes Grew Twice As Fast As Labour Income In 2021 The Outturn Was 26 7 Billion 4 Billion Or 17 More Than Forecast In Budget

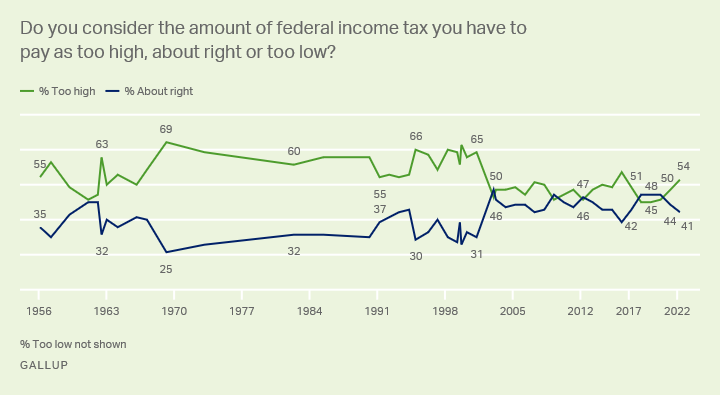

Taxes Gallup Historical Trends

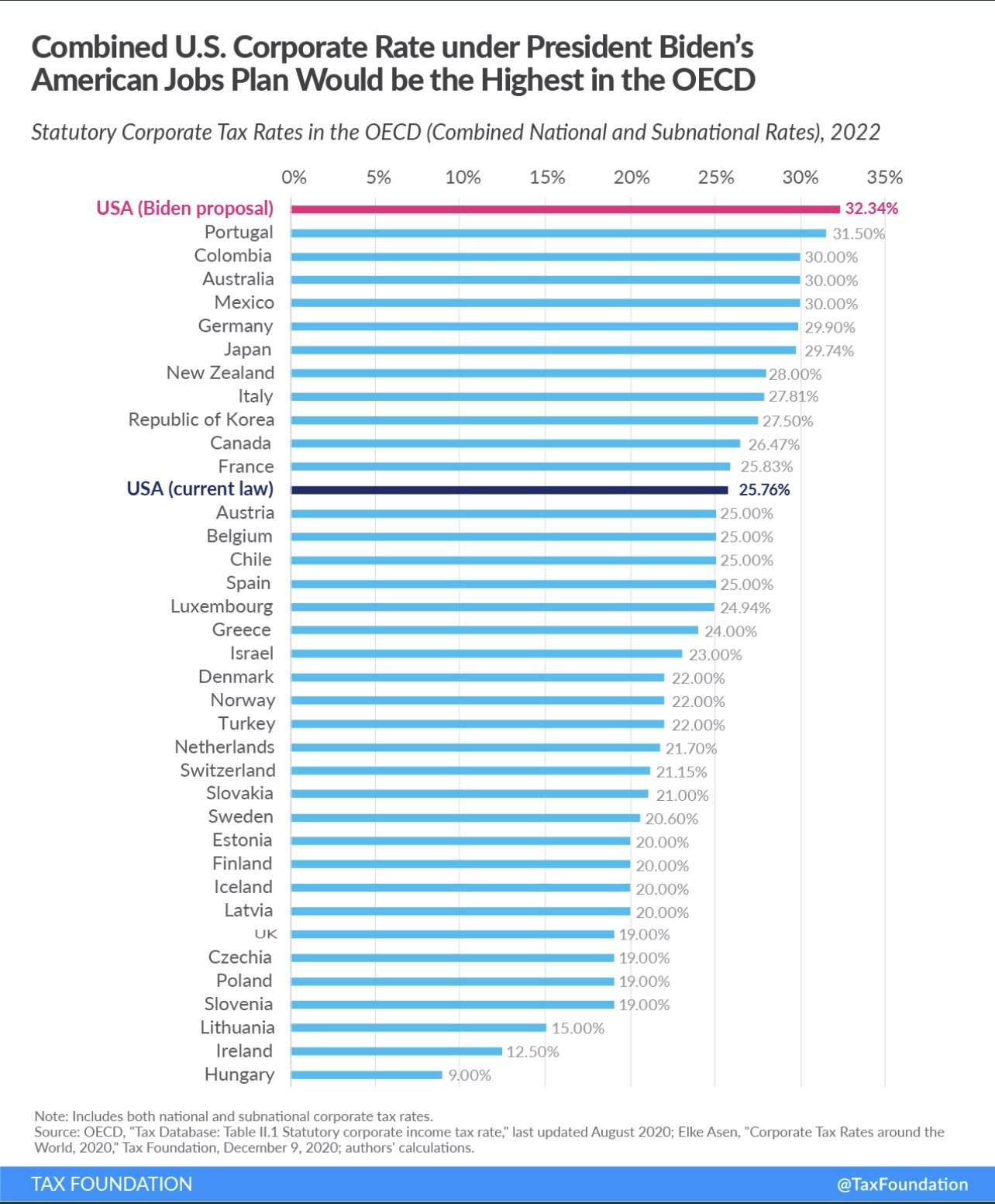

Mitch Roschelle On Twitter The Proposed Federal Amp State Income Tax Rate Of 32 34 Is Higher Than All Of Our Trading Partners See Taxfoundation Chart Below Meaning Global Competitiveness Is Lost

Taxation In The Republic Of Ireland Wikipedia

![]()

Ireland Salary Calculator 2022 With Income Tax Brackets Investomatica